in stock

In stock

Quickbooks 2020

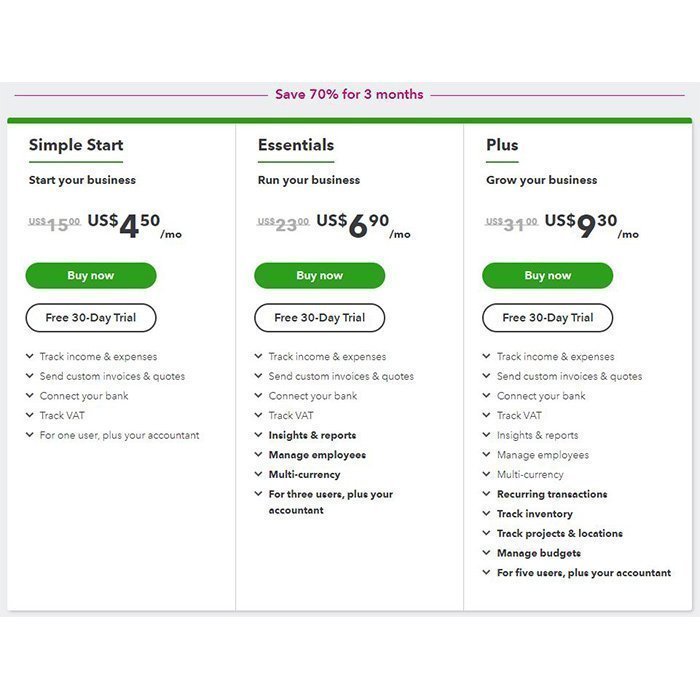

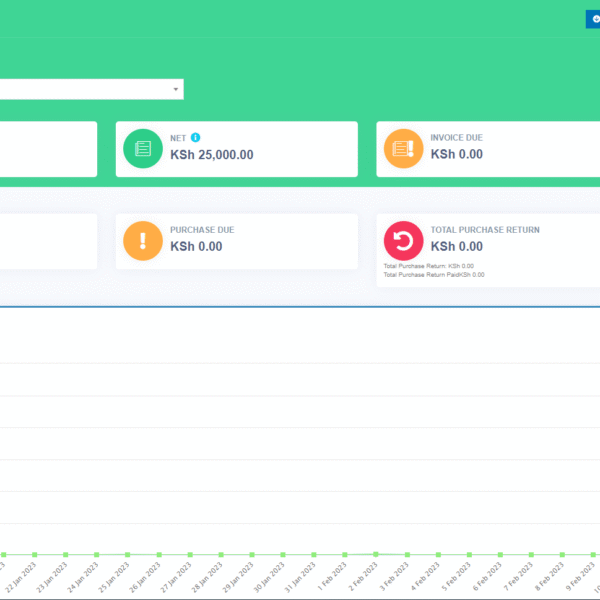

Price range: KShs25,300.00 through KShs140,250.00

QuickBooks includes features that allow you to keep track of your income and expenses, pay your employees, track your inventory, and simplify your taxes.

Description

Quickbooks 2020

QuickBooks is the most popular small business accounting software businesses use to manage income and expenses and keep track of the financial health of their business. You can use it for invoicing customers, paying bills, generating reports, and preparing taxes. The QuickBooks product line includes several solutions that work great for anyone, from a freelancer to a midsized business.

1. Create and Track Invoices

You can create invoices easily and either print them or email them to customers. QuickBooks will record the income and track how much each customer owes you automatically. You can view the amount of your outstanding invoices—known as your accounts receivable (A/R)—as well as how many days they’re overdue by running an A/R aging report. Below is a sample A/R aging report from QuickBooks Online:

2. Keep Track of Bills & Expenses

QuickBooks keeps track of your bills and expenses automatically by connecting your bank and credit card accounts to QuickBooks so that all of your expenses are downloaded and categorized. If you need to track a check or cash transaction manually, you can record it directly in QuickBooks in a few minutes.

You can also enter bills into QuickBooks when you receive them so that QuickBooks can help you track upcoming payments—or A/P. You can ensure that you pay your bills on time by creating an A/P report. This report will provide you with the details of your current and past-due bills. Below is a sample A/P aging report from QuickBooks:

3. Print Financial Statements for Your Business

By managing all of your cash inflow and outflow activities in QuickBooks, you can print financial statements that provide useful information about how your business is performing.

Lenders often require financial statements when you apply for a small business loan or line of credit.

You can produce these three primary financial statements in QuickBooks with a few clicks:

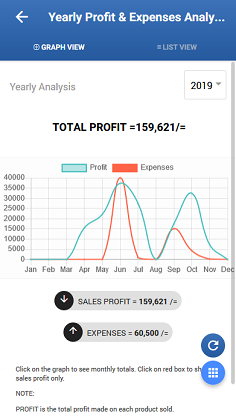

- Profit and Loss Report

- Balance Sheet Report

- Statement of Cash Flows

Profit and Loss Report

The Profit and Loss (P&L) Report will show you how profitable your business is by summarizing its income minus its expenses. The report shows you the bottom line net income (loss) for a specific time period, such as a week, a month, or a quarter:

Balance Sheet Report

The Balance Sheet Report shows what your business owns (assets), what it owes (liabilities), and its net worth (equity) at a particular point in time:

Statement of Cash Flows

The Statement of Cash Flows in QuickBooks will show you all of the activities that affect the operating, investing, and financing cash inflows and cash outflows for your business:

4. Track Employee Hours and Run Payroll

Payroll is an area that you don’t want to skimp on by trying to do it manually. Mistakes made in calculating paychecks can result in steep penalties and unhappy employees. QuickBooks has its own payroll function that can calculate and run payroll as often as you need it automatically.

QuickBooks can track your employees’ hours. The hours tracked then flow to both your customer invoices (if billable) and your payroll. This ensures that every hour you pay your employees for is considered for billing to a customer.

The best thing about using QuickBooks payroll is that it’s integrated with QuickBooks so that your financial statements are always up to date as of the latest payroll run. The purchase of a QuickBooks payroll subscription is required to run payroll, but you have several levels of service to choose from to fit your needs.

Running your payroll through QuickBooks will allow you to:

- Pay employees with a check or direct deposit

- Calculate federal and state payroll taxes automatically

- Have QuickBooks fill in the payroll tax forms for you

- E-pay your payroll taxes directly from QuickBooks

5. Track Inventory

QuickBooks can track the quantity and cost of your inventory. As you sell inventory, QuickBooks will allocate a portion of your inventory to cost of goods sold (COGS) automatically, which is an expense account that reduces your income. This allocation is a requirement for calculating taxable income and very cumbersome to do by hand. QuickBooks can also remind you to order inventory automatically when quantities are low.

6. Simplify Taxes

Perhaps the most important thing QuickBooks can do for your small business is to simplify tax time. By far, the largest headache in preparing a tax return is compiling your income and expenses. If you use QuickBooks during the year, all you need to do at tax time is print your financial statements. Better yet, with QuickBooks Online, you can invite your tax preparer to access your account directly so they can review your numbers and print whatever information they need to prepare your return.

7. Accept Online Payments

One of the best ways to improve your cash flow is to offer customers the option to pay their invoices online. You can add QuickBooks Payments (formerly known as Intuit Merchant Services) so that customers can pay online directly from their emailed invoice. QuickBooks Payments is similar to other merchant services. However, because it’s integrated completely within QuickBooks, the sale, credit card fee, and cash deposit are all recorded automatically as they occur.

Additional information

| Plans | PRO, ACCOUNTANT |

|---|---|

| Users | 1, 2, 3, 4, 5 |